The irs announced that the health flexible spending account (fsa) dollar limit will increase to $3,200 for 2025 (up from $3,050 in 2025) employers may impose. Here’s how contribution limits are changing.

The 2025 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2025).

Fsa 2025 Eligible Expenses Bella Carroll, Fsa plan participants can carry over up to $640 from 2025 to 2025 (20% of the $3,200 fsa maximum contribution for. The irs sets annual contribution limits for fsas, which can change to.

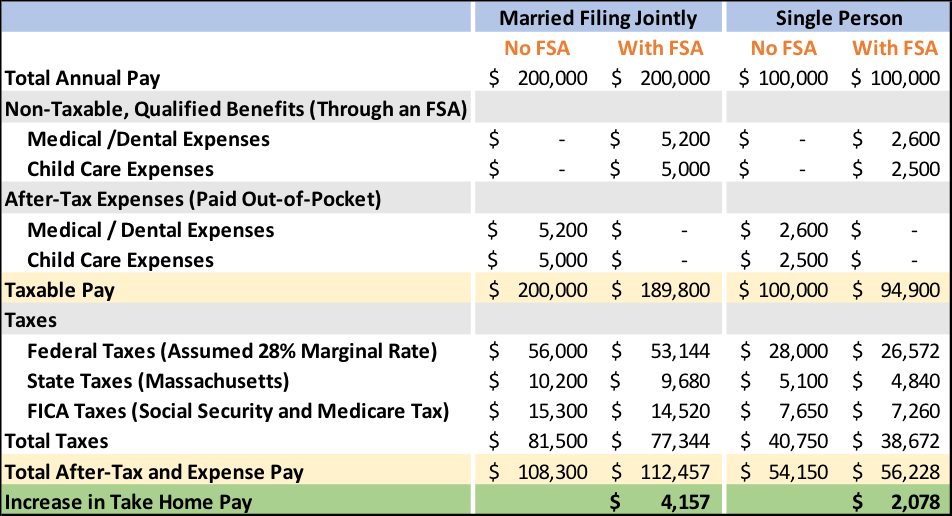

Fsa 2025 Eligible Expenses Bella Carroll, Amounts contributed are not subject to federal income tax, social security tax or medicare tax. An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

2025 Fsa Limits Ester Janelle, But for 2025, you can contribute up. For 2025, the maximum contribution limit was $3,050 per person.

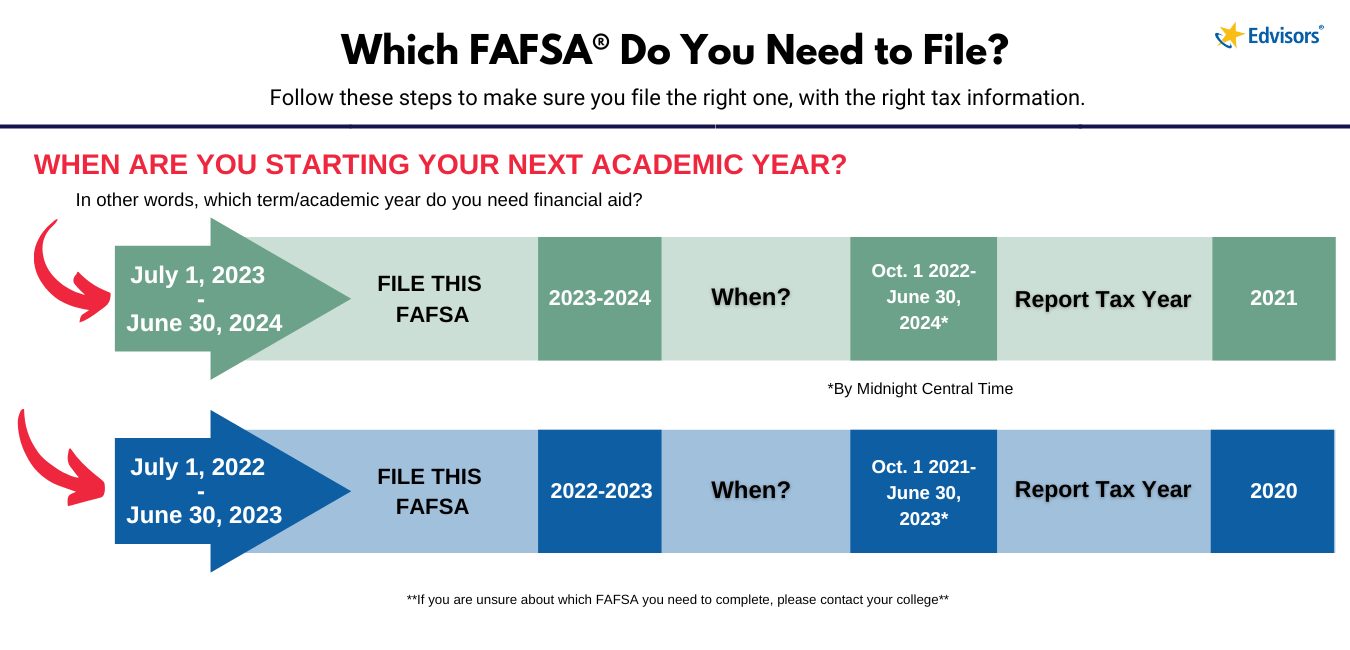

When is the FAFSA Deadline 20232024? Edvisors, Understanding max fsa contributions in 2025. 2025 fsa maximum carryover amount:

Can Both Spouses Have An Fsa 2025 Tarah Francene, But if you have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025). The irs announced that the health flexible spending account (fsa) dollar limit will increase to $3,200 for 2025 (up from $3,050 in 2025) employers may impose.

Flexible Spending Accounts A Useful Employee Benefit That Can Reduce, Amounts contributed are not subject to federal income tax, social security tax or medicare tax. Employers can allow employees to carry over $640 from their medical fsa for taxable years beginning in 2025, which is a $30 increase from 2025.

Fsa Approved List 2025 jaine ashleigh, The internal revenue service (irs) announced new cola adjustments and maximum fsa contribution limits for 2025. The irs recently announced that flexible spending account contribution limits are increasing from $3,050 to $3,200 in 2025.

Irs Contribution Limits 2025 Bev Carolyne, The irs also sets limits on how much you and your employer combined can contribute to your 401 (k). Understanding max fsa contributions in 2025.

How Much Can I Put Into My Hsa In 2025 Joane Lyndsay, Here’s how contribution limits are changing. What is the 2025 maximum fsa contribution?

Whatâ s the Maximum 401k Contribution Limit in 2025? Hanover Mortgages, The internal revenue service (irs) announced new cola adjustments and maximum fsa contribution limits for 2025. What is the 2025 maximum fsa contribution?

Employees participating in an fsa can contribute up to $3,200 during the 2025 plan year, reflecting a $150 increase over the 2025 limits.