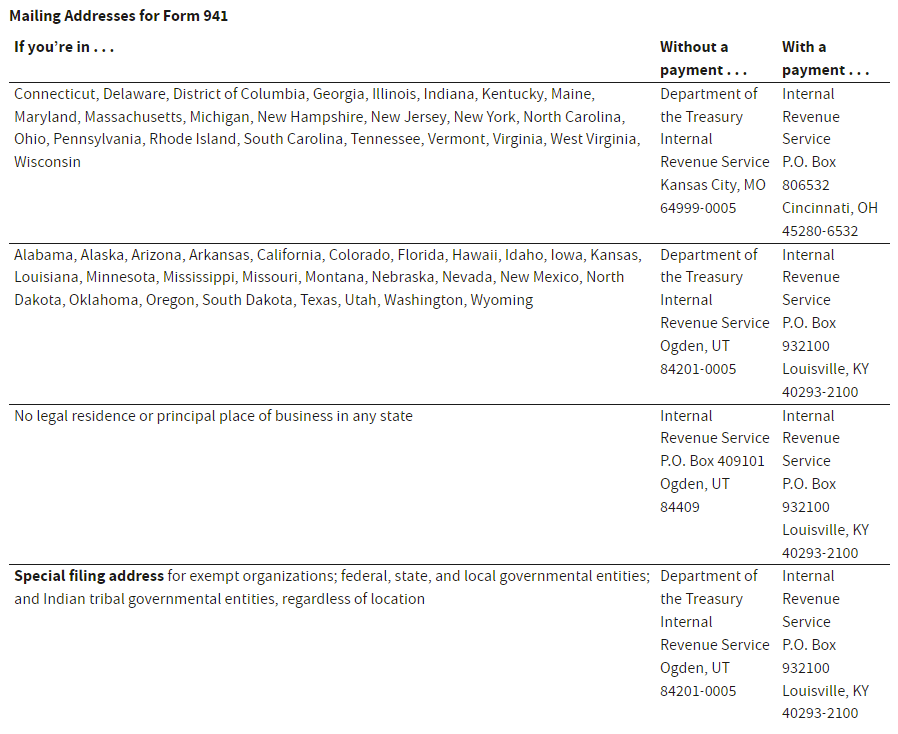

Form 941 Mailing Address 2025 No Payment Due. The irs has officially named this form as quarterly employer’s federal tax return. Be sure to check the correct 941 mailing.

For mailing without payment, use the address for your state or the special filing address for exempt organizations. The web page covers the updated form for 2025, the reporting period, the tax liability, and the late filing penalties.

941 Form 2025 Mailing Address With Payment Info Emlyn Iolande, For mailing without payment, use the address for your state or the special filing address for exempt organizations.

Irs Form 941 Mailing Address 2025 Aili Lorine, Find out how to mail form 941 to the irs based on your business location and tax payment status.

941 Mailing Instructions 2025 Maris Shandee, The web page covers the updated form for 2025, the reporting period, the tax liability, and the late filing penalties.

Form 941 Generator ThePayStubs, Learn how to mail form 941 without payment to the irs depending on your state and location.

941 Form 2025 Mailing Address With Payment Katy Saudra, The web page provides a link to the correct mailing address for each state.

Irs Form 941 2025 Mailing Address Rafa Ursola, If you are not submitting a payment with form 941, send the completed form to the appropriate irs address based on.

Form 941 Mailing Address 2025 No Payment Collie Sharona, Learn how to file irs form 941, the employer's quarterly federal tax return, and report payroll taxes for your business.

941 Form 2025 Mailing Address With Payment Voucher Hedwig Loraine, The web page covers the updated form for 2025, the reporting period, the tax liability, and the late filing penalties.