2025 Irs Deductible Limits. The 2025 maximum deductible limit for that age band is $5,960. $23,000 for 401 (k) plans, $7,000 for iras.

Depending on the type of donation and the organization, these limits generally range from 20% to 60% of your agi. 401 (k), 403 (b), 457 (b), and their roth equivalents.

The ira contribution limits for 2025 are $6,500 for those under age 50 and $7,500 for those 50 and older.

Irs Limits For 2025 Melva Sosanna, The 2025 maximum deductible limit for that age band is $5,960. The combined annual contribution limit for roth and traditional iras for the 2025 tax year is $7,000, or $8,000 if you're age 50 or older.

High Deductible Health Plan Deductible Limits 2025 Wendi Josselyn, However, the deductible cannot be more than $8,350, an increase of $450 versus the limit for tax year 2025. You may be able to claim a deduction on your individual federal income tax return for the amount you contributed to your ira.

Irs Limit 2025 Moll Teresa, Income thresholds for tax brackets will increase by approximately 5.4% for 2025. You may be able to claim a deduction on your individual federal income tax return for the amount you contributed to your ira.

Tax Deductible Ira Limits 2025 Brooke Cassandre, $23,000 for 401 (k) plans, $7,000 for iras. Taxable income is calculated by subtracting.

2025 Standard Deductions And Tax Brackets Helene Kalinda, Depending on the type of donation and the organization, these limits generally range from 20% to 60% of your agi. The 2025 maximum deductible limit for that age band is $5,960.

Tax Brackets 2025 Irs Single Elana Harmony, Those limits reflect an increase of $500 over the 2025. However, the deductible cannot be more than $8,350, an increase of $450 versus the limit for tax year 2025.

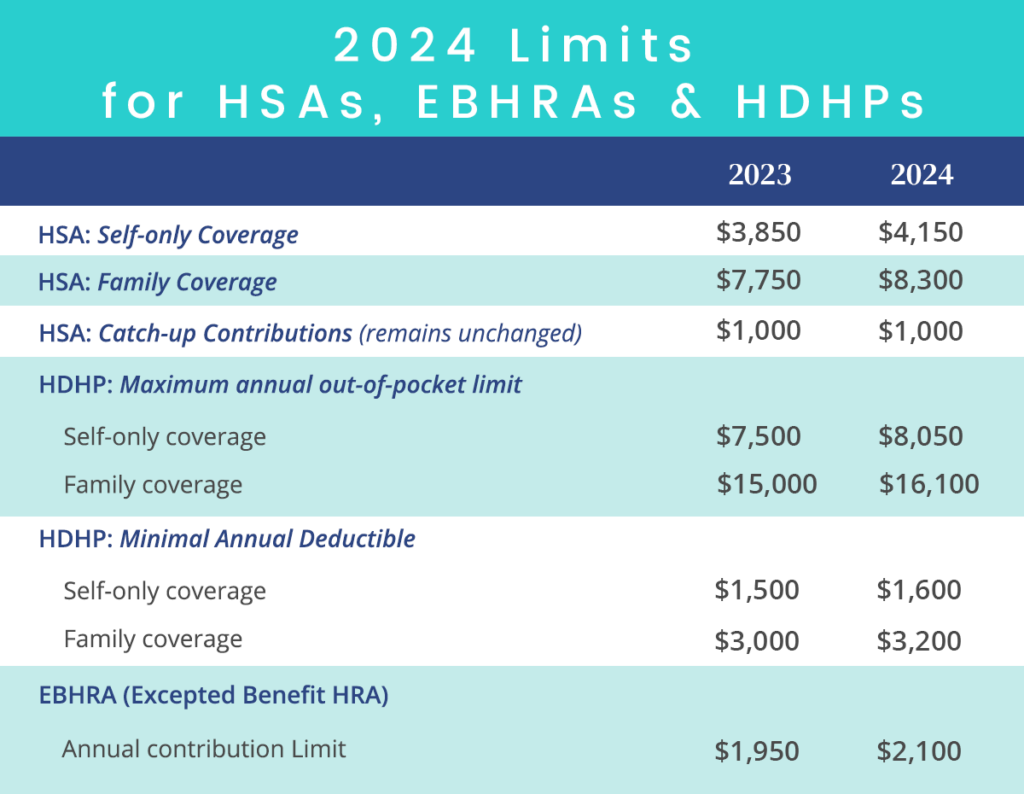

IRS Announces 2025 Limits for HSAs and HighDeductible Health Plans, Irs announces 2025 retirement account contribution limits: Irs bumps 2025 401 (k).

The IRS just announced the 2025 401(k) and IRA contribution limits, Taxable income is calculated by subtracting. For 2025, there is a $150 increase to the contribution limit for these accounts.

IRS Unveils Increased 2025 IRA Contribution Limits, The irs on april 25 released final regulations ( td 9993) on energy credit transfers that largely reject taxpayer recommendations to ease restrictions. For 2025, the ira contribution limits are $7,000 for those.

Simple Irs Contribution Limits 2025 Dore Nancey, The irs increased the 401(k) limits for 2025 to $23,000. The internal revenue service (irs) has announced that contribution limits for 401 (k)s, 403 (b)s, most 457 plans, thrift savings.

For tax year 2025, for family coverage, the annual deductible is not less than $5,550, an increase of $200 from tax year 2025;

Miss United States Of America 2025. Listen to miss grand thailand 2025 original soundtrack by […]

Worthy Women'S Conference 2025. Chips global summit 2025 connects and advances women in technology, law, […]